Recording of GST Inter-State Sales in Tally ERP9

Integrated tax (IGST) will attract when goods or services supplies to the other state customer.

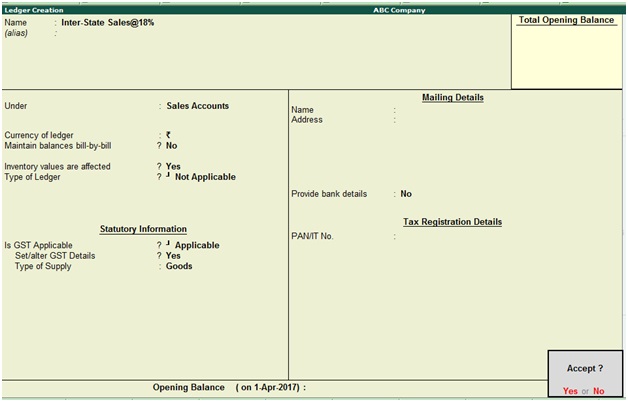

Ledgers Creation

Path: Gateway of Tally -> Accounting Info -> Ledgers -> Create

Name: Inter-State Sales@18%

Under: Sales Accounts

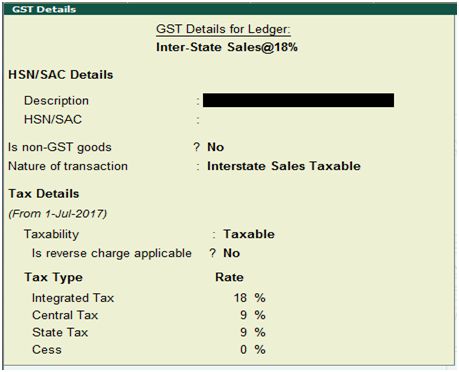

Set/alter GST Details: Yes, once enable this option then the below GST details screen will appear.

Nature of transaction: Interstate Sales Taxable

Taxability: Taxable

Rate: Set the GST rate as applicable

Press enter to save the screen

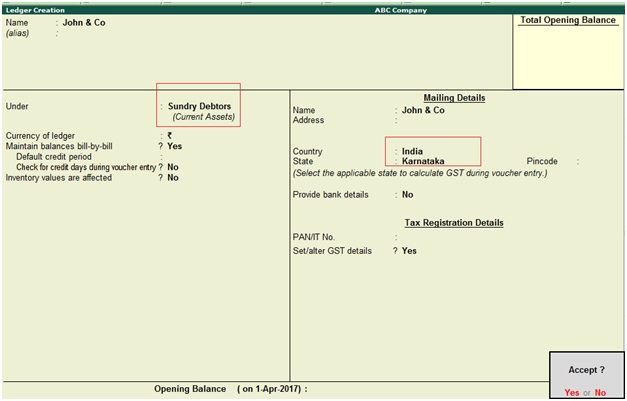

Sundry Debtors Ledger Creation

Name: John & Co

Under: Sundry Debtors

State: Karnataka

Press enter to save the screen

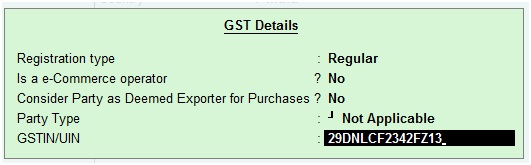

Set/alter GST details: Yes, once enable this option then the below GST details screen will appear.

Registration type: Regular

GSTIN/UIN: Enter customer GSTIN number

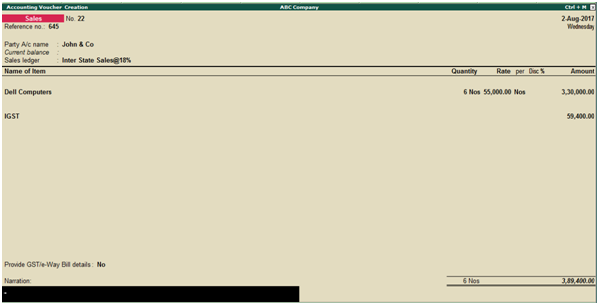

Recording of GST Inter-State Sales in Tally ERP9

Path: Gateway of Tally -> Accounting Vouchers -> F8 Sales

Example: Sold 6 Dell computers to John & Co, Bangalore each @55,000 with GST@18% (IGST@18%)

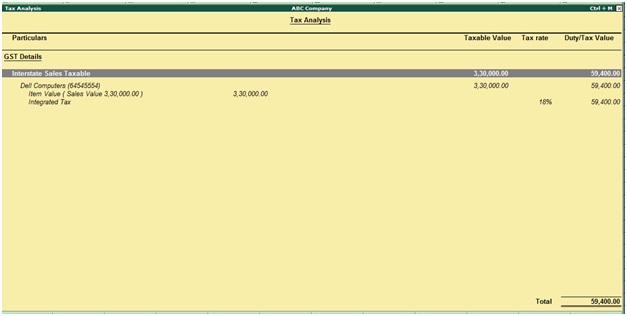

During the sales voucher screen click on Tax Analysis then the below screen will appear.

Click on detailed (Alt+F1) to view the GST tax details.

Related Topics

Create GST Tax Ledgers in Tally ERP9

Recording of GST Intrastate Sales in Tally ERP9

Sales to Consumers under GST in Tally ERP9

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9